Livestock Finance Key Features

100% Finance available of invoiced purchase

price -

Cattle only at the moment.

Maximum Term:

Up to 24 Months

Interest rate: currently 9.95% p.a. Interest charged monthly to customers nominated account by direct debit

Loan Security: Registered secured interest

on financed cattle

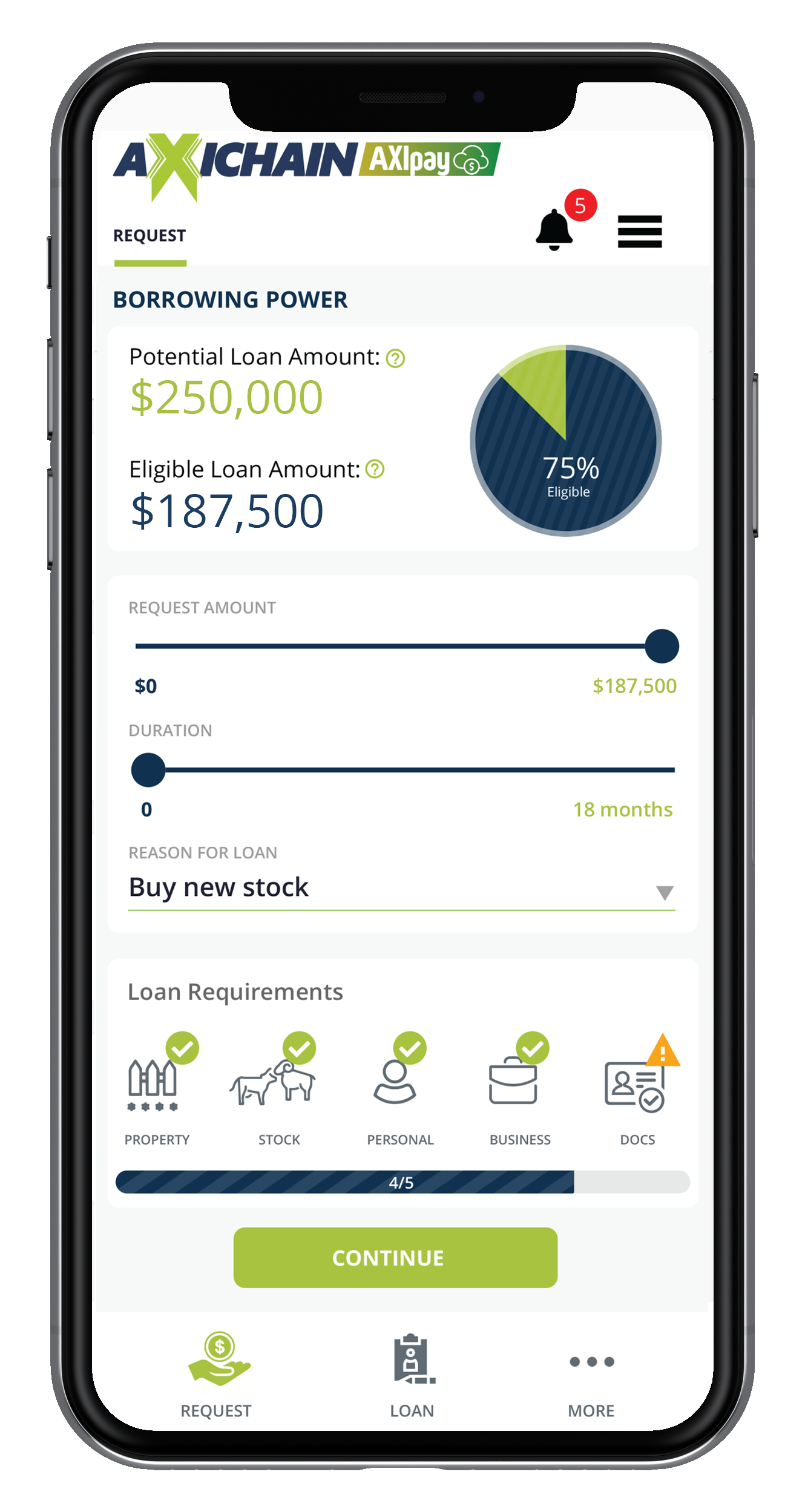

Applications up to $250k are subject to a Low Doc process. Full financial information is required for higher limits

$150.00 fee per drawdown

Finance is available to approved AXIchain

customers for business purposes

Terms and conditions apply